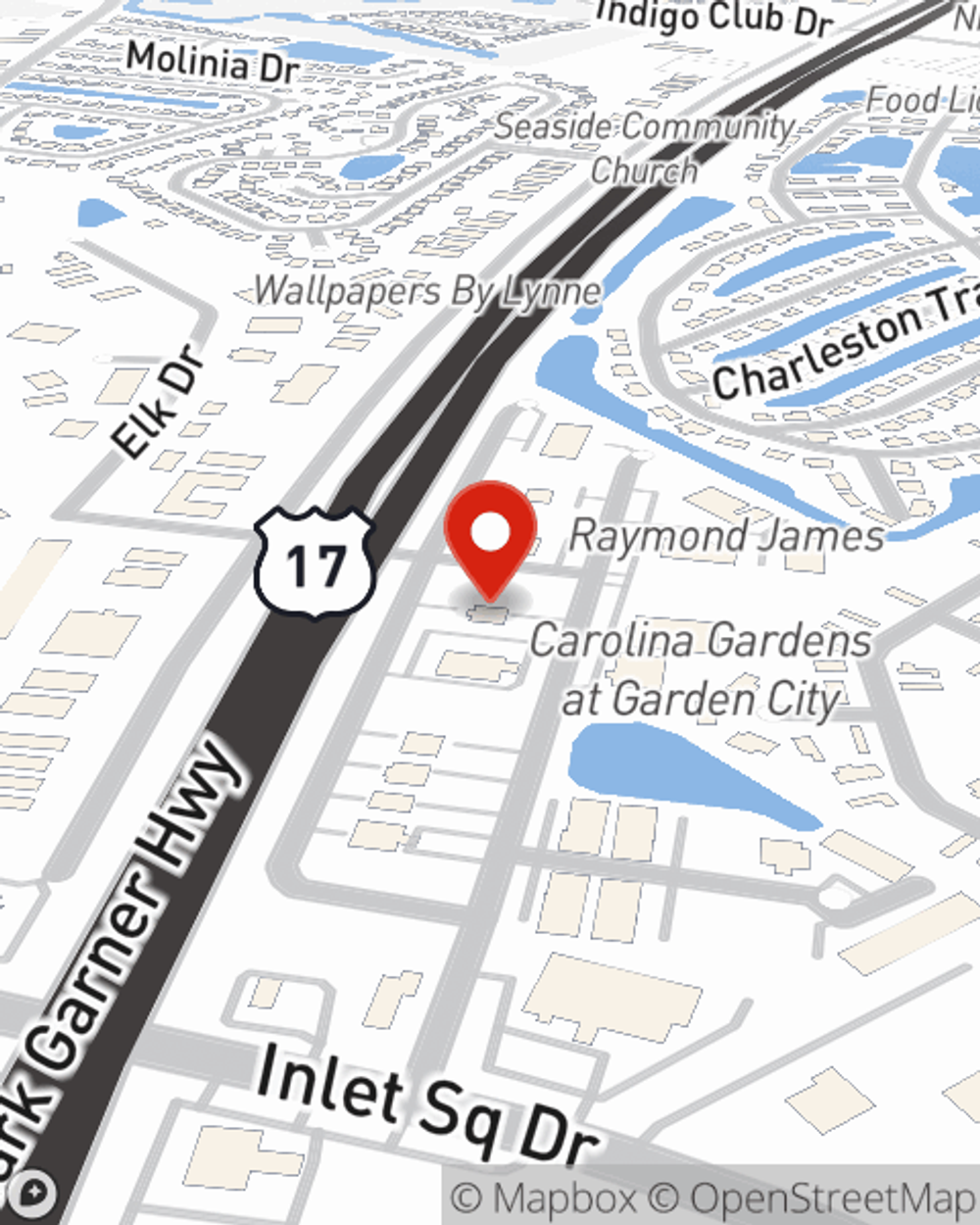

Business Insurance in and around Murrells Inlet

Get your Murrells Inlet business covered, right here!

Insure your business, intentionally

Help Protect Your Business With State Farm.

It takes courage to start your own business, and it also takes courage to admit when you might need support. State Farm is here to help with your business insurance needs. With options like business continuity plans, worker's compensation for your employees and a surety or fidelity bond, you can feel confident that your small business is properly protected.

Get your Murrells Inlet business covered, right here!

Insure your business, intentionally

Insurance Designed For Small Business

When you've put so much personal interest in a small business like yours, whether it's a gift shop, a yogurt shop, or a pizza parlor, having the right coverage for you is important. As a business owner, as well, State Farm agent Tom Leonard understands and is happy to offer personalized insurance options to fit what you need.

Call or email agent Tom Leonard to learn more about your small business coverage options today.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Tom Leonard

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.